Helping 5 Entrepreneurs With 400–600 Credit score

Get 700 Score & 100k in funding in 3–4 months?

Click learn more to schedule free credit strategy call

Get Funded. Get Free. Get Ahead.

Rebuild your credit. Secure up to $100K in funding.

We’re helping 5 entrepreneurs with credit scores between 400–600 get approved for major funding in just 3–4 months.

Our proven credit repair system helps you remove errors, boost your score fast, and position you for real capital — so you can finally fund your business or personal goals the right way.

Step One: We Review. You Rise

Before we build your personalized credit game plan, we’ll take a deep dive into your full financial profile — including your current credit status, history, and spending habits.

We’ll analyze your credit report line by line, spot the red flags holding you back, and create a strategy to boost your score and unlock funding — fast.

Personalized Credit Solutions: Tailored strategies to address your unique credit challenges and improve your financial health.

Credit Report Analysis: In-depth review of your credit report to identify errors, inaccuracies, or negative items affecting your score.

Dispute Resolution: We handle disputes with credit bureaus and creditors to remove inaccurate or unfair entries from your report.

Ongoing Support & Education: Guidance and tools to help you maintain a healthy credit score and make informed financial decisions.

Frequently Asked Questions

How does credit repair work?

Credit repair involves reviewing your credit report for inaccuracies or negative items, disputing those errors with credit bureaus, and taking steps to improve your overall credit score.

How long does the credit repair process take?

The credit repair process can take anywhere from a few months to over a year, depending on the complexity of your situation and the number of disputes required.

Can you guarantee my credit score will improve?

While we cannot guarantee specific results, our proven methods often lead to significant improvements by addressing inaccuracies and providing strategies for better financial management.

Will credit repair help with all types of negative credit items?

We can help resolve many negative items, such as errors, outdated information, and unfair entries. However, legitimate debts and accurate negative marks cannot be removed from your credit report.

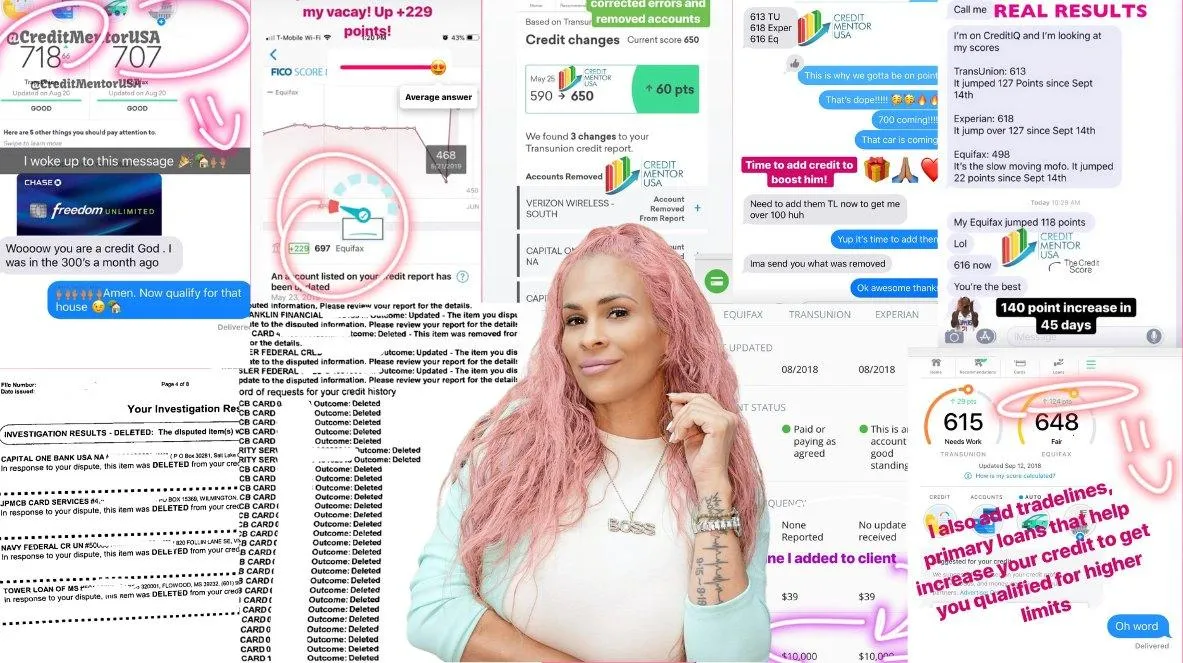

Success leaves clues

Results You Can’t Fake - Impact You Can’t Deny

Email: [email protected]